How is responsibility allowance calculated in Ghana?

Responsibility allowance

How is responsibility allowance calculated in Ghana?

Responsibility allowance in Ghana is an allowance given to some public sector workers who perform extra duties at their workplaces.

Some workers enjoy extra income for performing certain extra roles that are not originally part of their job description.

Though the workers benefit from the allowance for performing roles that can be considered part of their official duty. Both the employer and the employee agree such duties are not part of the core duties of the officers or their rank.

The employee and the employer, therefore, agree on the extra income that must be paid to the employee for performing such duties.

Others also read: New Policy on annual salary increment in Ghana

Responsibility allowance policy

The term responsibility allowance applies mostly to public sector workers. The new salary structure for public sector workers introduced the allowance.

The Single Spine Salary Structure (SSSS) is the new salary structure that uses the responsibility allowance to address some of the inequalities in public sector salary management.

The employer and labor unions agreed on the allowance. They agreed that some staff performs certain functions that are not core functions of the officer.

Ideally, the employer will be better off paying marginal income to existing staff to perform extra duties than to recruit new staff.

The government and labor agreed that lower-ranked staff must enjoy more responsibility allowance for performing extra tasks reserved for higher-ranked staff. However, they agree higher ranked staff must enjoy a relatively lower responsibility allowance for performing duties associated with higher-ranked staff.

This is the reason why staff with principal superintendent rank enjoy more amount as responsibility allowance than staff with ranks higher than the principal superintendent.

But all staff above the principal superintendent ranked enjoy the same 1.7% relativity ratio as responsibility allowance. Any employee above the principal superintendent rank will enjoy a 1.7% salary increase as a responsibility allowance

Meanwhile, staff on principal superintendent rank enjoy about four times (4x) the 1.7% salary increase as responsibility allowance

Is the allowance pensionable?

Pensionable income is any income that contributes to improved pension benefits. The responsibility allowance is pensionable in Ghana. This is because the allowance is added to the basic salary of the worker.

Basic salaries are pensionable in Ghana. Pension contributions are deducted from the basic salary. Therefore, pension contributions are deducted from the allowance since the allowance is added to the basic salary.

Employees must make efforts to enjoy the allowance if they are qualified to do so. This is because the benefits of the allowance include improved pension benefits.

The pension benefits include both lump sum benefits (tier 2) and monthly pension payments (tier 1)

Is the allowance taxable?

Taxable income is any income that is taxed. Responsibility allowance in Ghana forms part of the overall income of public sector workers. This is because the allowance is added to the basic salary of the worker.

The government taxes basic salaries in Ghana. Therefore, the government taxes responsibility allowance because they add to the basic salary.

The government tax responsibility allowance is at a rate of 17.5% for the majority of workers. This is because of the tax brackets in the country.

The upper band of most salaries falls within the 17.5% tax bracket. This means that workers’ extra income falls within the last tax bracket of 17.5%.

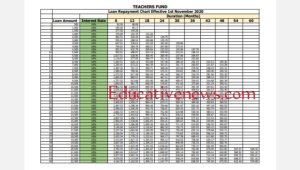

Responsibility allowance in Ghana Education Service

The staff of the Ghana Education Service (GES) also enjoy responsibility allowance. Classroom teachers usually perform administrative roles. Therefore, the classroom teacher must benefit from the allowance for performing administrative duties. This is because the administrative duty is not part of the core duty of the classroom teacher.

The staff of GES who perform solely administrative duties do not qualify for the allowance. For example, staff at Education offices and SISOs do not qualify for the responsibility.

The following staff in the Ghana Education Service rather qualify for the responsibility allowance

1. Headteachers at the basic level

2. Headmasters/ headmistresses at the senior high school level

3. Classroom teachers serving as form masters

4. Classroom teachers serving as housemasters and housemistresses

5. Classroom teachers serving as senior housemasters and senior housemistresses

6. Assistant headteachers and assistant headmistresses at the senior house school level

7. Councilors at the senior high school level

8. Chaplain at the senior high school level

The employer and teacher union agreed that the category of teachers listed above performs certain functions that are originally part of their core duties. They, therefore, agree such teachers must enjoy the allowance.

How to ask for the allowance in GES

The employer, through its officers, must appoint a teacher to perform a role that deserves a responsibility allowance before he or she can benefit from the allowance.

The appointing authorities reserve the right to appoint staff to the roles that deserve the allowance. However, some staff lobby for such roles.

Application for the allowance

Any staff who appointed and issued a letter to a role deserving of responsibility allowance can apply for the allowance.

Staff must apply to the Director General of Ghana Education Service to enjoy the allowance. The staff at the basic level must apply through the district director of education office using the appropriate letter as a prove. Teachers in the senior high schools must apply through their head of institutions as well as the district director of education

How to calculate responsibility allowance in GES

Staff can calculate responsibility allowance even before the government pays them. Some teachers sometimes defer processing their documents after calculating the allowance for their rank. However, teachers with the rank of principal superintendent must hurry to process their documents since the amount is substantial

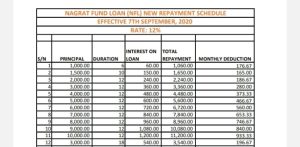

Employees above the rank of principal superintendent benefit from 1.7% of their standard gross salary.

The gross salary is basic salary plus retention premium (that is, basic salary + retention premium).

For example if your current basic salary is Ghc2000 and your retention premium is Ghc300, then your gross is Ghc2000 + Ghc300 = Ghc2300

The responsibility allowance before tax will be = 1.7% of Ghc2300

The allowance before tax = 1.7/100 (Ghc2300)

The allowance before tax = 0.017 (Ghc2300)

Responsibility allowance before tax = Ghc39.1

Employees with the rank of principal superintendent gain about four times the percentage enjoyed by the ranks above the principal superintendent. That is about 6.4% of their standard gross salary. Affected staff can replace the 1.7% used in the previous calculation with the 6.4% to determine their amounts.

Finally, the government charges a 17.5% tax on the amount. Pension authorities also deduct pension contributions from the basic salary components. The employer pays the remaining amount to the worker.

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by Educative News and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.