New GNAT loan chart

GNAT loan chart

New GNAT loan chart

New GNAT loan chart: The Ghana National Association of Teachers (GNAT) has a loan repayment chart. The GNAT loan chart guides members who access loans from the union.

The Ghana National Association of Teachers (GNAT) is the largest teachers’ union in Ghana. GNAT has a welfare mutual fund called the Teachers’ Fund. The mutual fund provides loans to members. The teachers’ fund, therefore, designed the GNAT loan chart to guide members of the association who access loans from the fund.

People consider many factors before accessing loans from any institution. Some of the factors are the repayment period and the regular repayment installments.

For this reason, the Ghana National Association of Teachers (GNAT) designed the GNAT loan chart to guide members.

Brief history

The Ghana National Association of Teachers (GNAT) has been in existence for over ninety-one (91 years). GNAT is, therefore the largest teachers’ union in the country. All other teachers’ union emanates from the union.

The union has an objective to safeguard the welfare of members. The union has, therefore, established a welfare mutual fund scheme for members of the union. The welfare fund is called the teachers’ fund.

Members of the union must register to become part of the teachers’ fund. The members contribute a minimum amount of money as members.

The scheme is therefore voluntary for members to join. This means that teachers can be members of GNAT but may decide not to join the mutual fund.

Members of the GNAT’s teachers’ fund pay a minimum contribution of fifty Ghana cedis (Ghc50). This welfare fund’s payment of Ghc50 is different from the general membership dues that members must pay. All members of the Ghana National Association of Teachers pay membership dues of Ghc47.51.

Benefits of the GNAT mutual fund (teachers’ fund)

The primary benefit of the mutual fund is that the fund serves as a voluntary retirement income for members of GNAT who join the fund.

The fund, therefore, has two main benefits. Members have the opportunity to save towards their pension. The fund also provides loans to members.

Members who join the fund qualify to access loans from the fund. Many members join the mutual fund to take loans from the welfare fund.

Though the primary purpose of other members joining the GNAT mutual fund is to benefit from the proportional distribution of interest on the fund to members.

Members who take a loan from the fund pay interest on the loan. The mutual fund shares the interest and other investment income of the fund to members of the fund. The union shares the interest according to the proportional contribution of members.

This means that members of the GNAT mutual fund who contribute more to the fund enjoy more of the interest that members pay on the loan they take. Additionally, members who contribute less amount of money to the teachers’ fund receive less dividends on their contributions.

Conditions for taking loans and maximum loan amounts

Members of the GNAT mutual fund contribute a minimum amount of fifty Ghana cedis (Ghc50.00). Members of the union qualify to take loans below ten thousand Ghana cedis (Ghc10,000.00).

Accordingly, members’ monthly contribution to the fund determines how much loan a member can access.

Though the convention is that members must contribute at least one percent (1%) of any loan amount a member wants to access. However, many members contribute less than the 1% loan amount that they access.

New members who want to access a loan from the GNAT mutual fund must contribute for a minimum of six (6) months to qualify for a loan. Also, many members manage to access loans in less than six (6) months of joining the union.

Members are also allowed to contribute as much as they wish to contribute. This is because members who contribute more stand the chance to enjoy more dividends than members who contribute less amount.

GNAT members have the opportunity to access four different types of loans. Which are personal loans, habitat loans, investment loans, and auto/car loans.

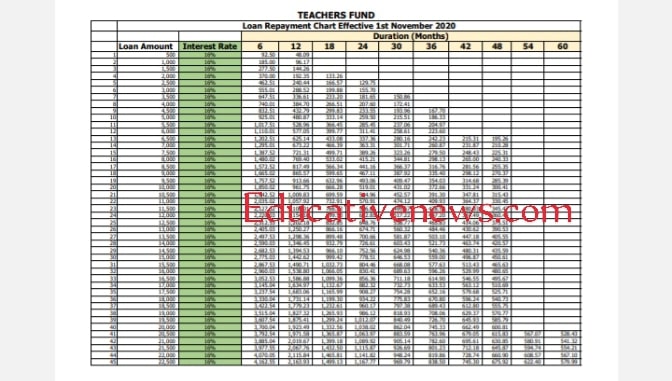

GNAT loan chart

The GNAT loan chart provides a detailed repayment plan to any member who wishes to access the GNAT loan. The GNAT loan chat is a combination of how much a member will repay every month as well as how many months the members will use to repay the loan.

Though many members use the GNAT loan chart to decide on the maximum amount of loan they can access for the maximum length of time.

It is, rather advisable that members use the GNAT loan chart to access the approximate amount of money that would solve their impending financial obligations.

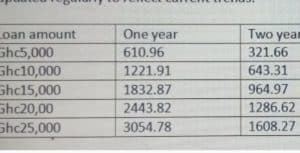

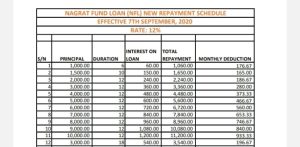

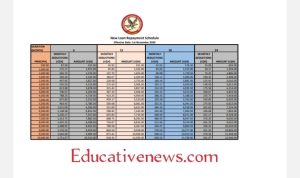

Attached is the GNAT loan chart here: GNAT Teachers mutual fund loan chart. Compare the GNAT loan chart with the CCT loan chart and NAGRAT loan chart

Loan charts for some other mutual fund may quote less interest rates. However, their actual deductions are more than the deductions on GNAT loan chart with relatively higher interest rate

Importance of the loan chart and comparison with other unions’ loan charts

First of all, loan charts are the best way to compare loan repayment obligations. This is because almost every loan customer is unable to calculate the final interest financial institutions expect them to pay.

Therefore, the simplest way to compare loan repayment obligations from multiple institutions is to compare their loan charts. This is because the interest charge and other obligations on the loan reflects in the loan repayment chart.

For example, the insurance premium on the loan as well as processing fees etc all reflects in the repayment amounts.

Also, the customer does not need to ask too many questions that may not receive the appropriate answers. Especially, the loan chart reveals all hidden charges like the loan insurance premium and processing fees, controller deduction fees, etc.

The loan charts for other teachers’ unions and major financial institutions have thus been provided here. NAGRAT, CCT-GH

GNAT members’ dues

Members of the Ghana National Association of Teachers must pay membership dues. The membership dues are different from the contributions that members must make to the welfare mutual fund.

The membership dues are Ghc47.51. The amount is fixed for every member of the union to pay throughout the year. The union reviews the membership dues annually.

Members of the Ghana National Association of Ghana (GNAT) also have a cancer fund for members. Members pay a mandatory amount of five Ghana cedis (Ghc5). Every member of GNAT pays the cancer fund dues.

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by Educative News and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

How you are treating us (nat members) is very unfair.Applying for a loan for (3month)and haven receive your cheque and deduction have began.Please very very bad . When you call too you are to call back later to check if the cheque will be ready.Meanwhile July they will deduct again.WHY?