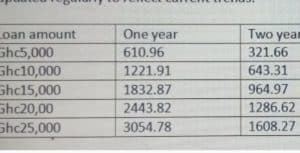

New CCT loan chart

CCT loan chart

New CCT loan chart

CCT is simply a Coalition of Concerned Teachers. It is a teachers union in Ghana. The CCT loan chart is thus provided here for interested persons. The CCT loan chart is a chart that displays the loan repayment plan for the union.

See also: 6 Factors to consider when taking loans

Brief history

The Coalition of Concerned Teachers in Ghana (CCT-Gh) has established a welfare mutual fund scheme for members of the union.

Members of the union must register to become part of the mutual fund scheme. The members contribute a minimum amount of money as members. The scheme is therefore voluntary.

Benefits of the CCT mutual fund

Members who join the mutual fund are qualified to take a loan from the fund. Most members join the mutual fund to access loans. Though some members join the fund to benefit from the mutual distribution of interest on the fund.

When members access loans from the fund, they pay interest on the loan. The union, therefore, shares the interest that members pay on the funds that every member contributes proportionally.

This means that people who contribute more to the fund enjoy much of the interest that members pay on the loan they take. Also, members who contribute the least amount of money to the fund receive less dividend on their contributions.

Conditions for a maximum loan amount

The least amount of money CCT members can contribute to the fund is forty Ghana cedis (Ghc40.00). The least amount of Ghc40 qualify members to access a maximum of five thousand Ghana cedis (Ghc5,000.00).

Accordingly, the amount of money that members contribute determines the maximum amount of loan that members can access.

Members who contribute one hundred Ghana cedis (Ghc100.00) can access a maximum of only ten thousand Ghana cedis (Ghc10,000.00).

Additionally, members who contribute a maximum of one hundred and twenty Ghana cedis (Ghc120.00) can access a maximum of only fifteen thousand Ghana cedis (Ghc15,000.00).

Finally, members who contribute one hundred and fifty Ghana cedis (Ghc150.00) can access a maximum of twenty thousand Ghana cedis (Ghc20,000.00).

However, members are allowed to contribute as much as they wish to contribute. This is because members who contribute more stand the chance to enjoy more dividends than members who contribute the least amount.

CCT loan chart

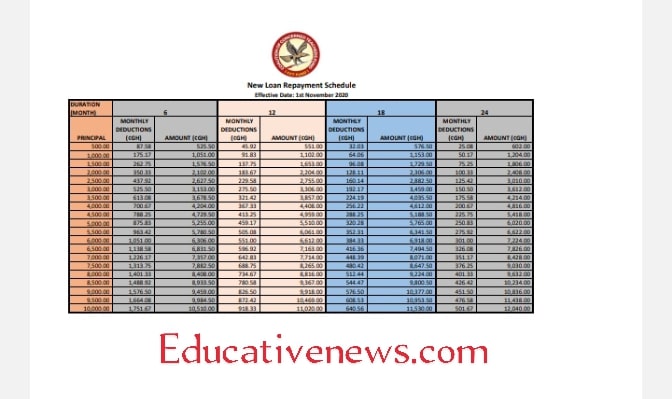

The CCT loan chart provides a detailed repayment plan to any member who wishes to access a CCT loan. The CCT loan chat is a combination of how much a member will repay every month as well as how many months the members will use to repay the loan.

Though many members use the CCT loan chart to decide on the maximum amount of loan they can take for the maximum length of time.

It is, rather advisable that members use the CCT loan chart to access the approximate amount of money that would solve their impending financial obligations.

Attached is the CCT loan chart

New CCT LOAN CHART Download here

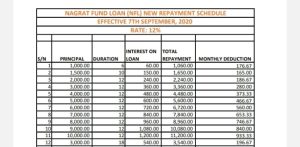

Importance of the loan chart and comparison with other unions’ loan charts

First of all, loan charts are the best way to compare loan repayment obligations. This is because almost every loan customer is unable to calculate the final interest financial institutions expect them to pay.

Therefore, the simplest way to compare loan repayment obligations from multiple institutions is to compare their loan charts. This is because the interest charge and other obligations on the loan reflects in the loan repayment chart.

For example, the insurance premium on the loan as well as processing fees etc all reflects in the repayment amounts.

Also, the customer does not need to ask too many questions that may not receive the appropriate answers. Especially, the loan chart reveals all hidden charges like the loan insurance premium and processing fees, controller deduction fees, etc.

The loan charts for other teachers’ unions and major financial institutions have thus been provided here. NAGRAT, GNAT, GCB, Fidelity, etc.

CCT-Gh members dues

Members of the Coalition of Concerned Teachers – Ghana (CCT-Gh) must pay membership dues. The membership dues are different from the contributions that members must make to the welfare mutual fund.

The membership dues are thirty Ghana cedis (Ghc30.00). The amount is fixed for everyone to pay throughout the year. The union reviews the membership dues annually.

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by Educative News and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.