6 Factors to consider when taking loans

when taking loans

6 Factors to consider when taking loans

Loans are normal financial transactions. And loans are a necessity. Loans are not a luxury. Loans are accessed to solve peculiar issues. However, there are factors to consider when taking loans.

The inability to properly examine the factors can become an albatross around the neck of the customer. An albatross because the factors are mostly rooted in the terms and conditions of the loan document. Financial Institutions would not pardon an individual for their inability to read the terms and conditions in the loan agreement.

Having a fair idea about aspects of the terms and conditions of the loan agreement could inform your decision to discontinue processing the loan. Individuals are therefore encouraged to read through any loan agreement carefully before going ahead to sign.

Why people do not examine loan documents

Some people feel lazy to read the loan application forms. Though the volume of most loan agreements is not substantial, many people do not just have the luxury of interest to read through the documents. Laziness to read the document could become a regret that can never be corrected.

The nature of the characters used in writing the loan agreement is a major reason people do not like reading loan documents. The characters used are mostly small font sizes. It can be argued by the financial institutions that the reason for using the small font sizes is due to the intention to compress all terms and conditions of the loan into the small number of papers used for the documents. However, an ulterior motive to present a small font size that people will discourage the customers from reading

The urgent need for loan money is a primary reason people do not read loan documents. Sometimes, the need for the amount urgently is used as an excuse not to properly peruse the loan documents. In such instances, people think reading the loan document is a waste of time and an attempt to read through the document will delay the process.

Also, others do not believe that they can become worse off in the course of servicing the loan due to their inability to properly peruse the loan application. It is therefore considered irrelevant to read the loan document.

Overwhelming trust in the words of loan officers. Loan officers would usually explain some of the conditions in the loan agreement to the customer. However, some of the sensitive clauses in the documents are left out of the explanation. Sometimes, such sensitive clauses are mentioned but are explained in a positive light.

Importance of reading the loan document

Customers must read every bit of the loan application forms. Reading every bit of the document would reveal everything that the customer would not have known about the particular loan.

The loan application forms contain the terms and conditions of the loan. The terms and conditions of the loan are the agreement or the basis on which the loan was granted. Therefore, why would anyone go into any transaction without knowing the conditions whether punitive or incentive associated with the transaction?

Revelations in loan documents

Customers would find the following sensitive information in the loan agreement before deciding to sign up for the loans

1. Interest rate

2. Interest rate type

3. Type of loan

4. Deduction dates

5. Early settlement clauses

6. Refinancing clauses

1. Interest rate

The interest rate for the loan will be specified in the loan document. However, the interest rate that will be applied to the loan will be different from the one stated in the document. This is because the document might have been printed long ago while the bank will be using a current interest rate. However, knowing this information will enable the customer to ask the loan officer for emphasis on the rate being applied.

The best part of this section of the document is that it reveals whether the interest being charged is either simple interest or compound interest. A loan with compound interest is not recommended for anyone.

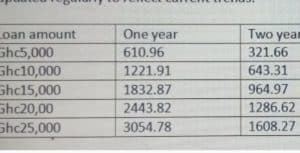

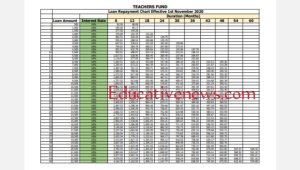

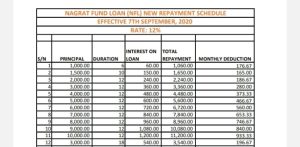

It must be stated that it is difficult comparing or analyze interest rates from different financial institutions to settle on one. However, the best way to compare loans is to compare deductions from different banks for the same amount. This is because all the interest rates, insurance on the loan, and other service charges by the bank will reflect in the installment deductions.

2. Interest rate types

Interest rates on loans can be either simple interest or compound interest.

Also, the interest rate can be either fixed interest or flexible interest. Fixed interest rates mean the interest rate is fixed or locked in throughout servicing the loan. A flexible interest rate means the interest rates can be varied over the lifetime of the loan. In such cases, the interest could be revised downwards or upwards. The revision of the rates is influenced solely by the economic indicators in the country.

It should be recalled that customers became aware of the provision to adjust interest rates in their loan portfolio only when customers with such loan facilities were notified by their bankers last year about its decision to increase the interest rate on their loans due to unfavorable economic conditions in the country

When fixed interest is applied to loans, the interest rates will never be varied over the lifetime of the loan.

3. Loan Type

Loans are classified differently. There are personal loans, business loans, auto loans, mortgages, etc. The type of loan also determines the perceived risk associated with it. Though all loans are considered to be risky by financial institutions, some of the loan types are considered to be more risky.

The higher the risk that is associated with the loan, the higher the interest that will be associated with the loan. Individuals must be sure they are signing up for the loan type they wanted. This is because financial institutions can match up a different type of loan to the desire of the customer.

4. Deduction dates

Loan deductions are effected on specified dates in the loan agreement. This date for deductions can be at the disadvantage of the customer. Therefore, the customer can insist on deduction dates that suit him or her. Whether there is no room to change such a deduction date, the customer has the option to look elsewhere for his or her loan.

Whenever a financial institution is unable to deduct its loan obligation from the account of the customer, the bank treats the inability to deduct as a default. In such instances, a penalty will be charged on the default amount. This means the customer must have funds available at the due date for deductions to avoid paying consistent default penalties.

For instance, some banks state their deduction dates to be the 21st of every month. This date must have though on purpose. This is because most salary workers will not have any money in their bank account around the 21st of every month.

See also: BoG discloses the status of banks and interest rates in the country

5. Early settlement clauses

Loans can be settled anytime. However, financial institutions would charge a penalty for settling a loan too early. This penalty for settling the loan too early is based on the assumption that the loan would have been given to another customer who could have paid the full interest on the loan over the lifetime of the loan.

Every bank has its early settlement clauses. While some financial institutions charge a penalty for early settlement before half of the loan’s lifetime, other financial institutions waive this penalty charge. The rest of the financial institutions have a clause based on how much of the loan was paid through installments to determine the penalty for early settlement.

6. Refinancing clauses

Loan refinancing is termed a loan top-up by many people. The action refers to the process where a new bigger amount of loan is given but the outstanding loan balance of an existing loan facility is deducted from the new bigger amount.

There are also clauses in loan agreement forms that determine when a customer can refinance his or her loan. Just like the early settlement clauses, every financial institution has a clause that determines how much of the previous loan must be paid before a new top-up loan is given.

Reference: investopedia.com

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by Educative News and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.