New NAGRAT loan chart

NAGRAT loan chart

New NAGRAT loan chart

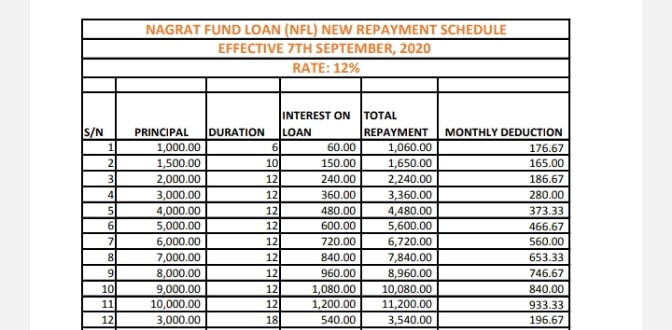

NAGRAT loan chart is one of the best in the country. The NAGRAT loan chart is hereby provided below. The National Association of Graduate Teachers (NAGRAT) is the second-largest teachers’ union in the country. The union is originally made up of teachers with degrees. Now, however, any other category of teachers can join the union.

The loan chart from NAGRAT is a chart that displays a loan repayment plan for interested members. Members who wish to access a loan from NAGRAT could use the loan chart as a guide

See also: New CCT loan chart

Brief history

The National Association of Graduate Teachers (NAGRAT) has established a mutual fund to address the financial welfare of members.

Members of the union must register to become part of the mutual fund scheme. The welfare fund is, therefore, voluntary and members must contribute a minimum amount of money. But members can also contribute an extra amount.

Benefits of the NAGRAT mutual fund

The NAGRAT mutual fund provides one of the cheapest loans in the country. The fund gives loans to members at twelve percent (12%). Members can, therefore, take more loan amounts compared with loans from commercial banks in the country.

It is, however, unclear why NAGRAT loan deductions is higher than that of the GNAT loan deductions.

Members also receive shared interest from the profits the NAGRAT mutual fund makes. The more members contribute to the fund, the more profits they will receive.

Also, members who contribute more to the fund have the chance to access more loans than members who contribute less.

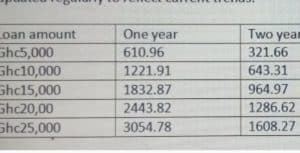

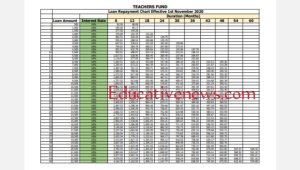

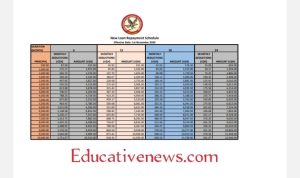

NAGRAT loan chart

The GNAT loan chart covers loan amounts ranging from one thousand Ghana cedis (Ghc1000) to forty thousand Ghana cedis. Members can therefore access amounts between the Ghc1000 and Ghc40,000

Members are allowed to repay the loan between six (6) months to five (5) years. But the loan amount members can access and repayment period depends on the member’s loan affordability.

The minimum amounts members can contribute to the fund is fifty-five Ghana cedis (Ghc55). Also, members must contribute for a minimum of six (6) months to qualify for a loan.

In addition, members must increase their fund contribute when they need loan amount that is more than five thousand Ghana cedis (Ghc5,000).

Download the NAGRAT loans chart here

NAGRAT digitalization

The union is the first to introduce digitize channels in applying and processing loans from the union. Members have to log in to their accounts at https://www.nagratfund.com/index.php?action=Login to apply for the loans. The processing and the disbursement of the loan is also done electronically.

Other benefits for NAGRAT members

a. The National Association of Graduate Teachers (NAGRAT) has other financial benefits for members. The union has an agreement with UBA and ABSA at the rate of 17.6% + 3% = 20.6%.

The 17.6% is the rate UBA actually charge members of NAGRAT. And the 3% is amount the Controller and Accountant General Department (CAGD) charges. In total, the member pays 20% interest on the loan agreement that NAGRAT has with UBA and ABSA for NAGRAT members.

b. NAGRAT also allows partial withdrawal from the mutual fund. This means that members of the fund can request a portion of their contributions whenever the want.

c. NAGRAT equally has an agreement with Methodist University for members who wants to go for further studies. NAGRAT members are given a huge discount of the fees that students are required to pay.

NAGRAT Loan chart over interest rates

It is advisable for NAGRAT members to compare the NAGRAT loan chart deductions for the same loan amount from different institutions instead of comparing interest rates.

This is because the interest rates may not correlate with repayment deductions. Some institutions exempt certain charges from the interest rate disclosure. Also, some institutions may exempt processing fees and loan insurance premium from their interest rate calculation.

However, all charges, fees and interest rates reflect in the loan repayments. NAGRAT members should therefore utilize the NAGRAT loan chart to compare loan deductions from the union’s fund and loan from other institutions

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by Educative News and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.