Financial Accounting Mock Questions

financial accounting mock questions

Financial Accounting Mock Questions

Financial accounting mock questions: The mock question have been designed to prepare the candidates adequately for the final examination.

PAPER 1: OBJECTIVES TEST

1. The principal book of account where accounts are classified and summarized is

A. Journal C. Trial balance

B. Ledger D. Balance sheet

2. The Which of the following is the basic accounting equation

A. Assets + Liability = Equity

B. Assets + Equity = Liability

C. Assets – Liability = Equity

D. Liability – Equity = Assets

see also: PARKOSO SHS economics mock questions

3. Who among the following groups is an external user of financial statements?

C. Government agencies C. Management

D. Board of directors D. Employees

Financial accounting mock questions

4. When drawings are made by the owner of a business, it results in

A. A decrease in capital

B. An increase in cash

C. A decrease in liabilities

D. An increase in liabilities

see also: PARKOSO SHS WASSCE core maths mock questions

5. The capital account without a current account in a partnership business is

A. Fluctuating capital C. Fixed capital

B. Shareholder’s capital D. Long term capital

6. In the purchase of a business, a buyer has paid more than the value of net assets of the business. The excess payment is referred to as

A. Bonus C. Net profit

B. Premium D. Goodwill.

Financial accounting mock questions

7. When the total of the debit of income and expenditure account exceeds the total credit side, the difference is

A. Deficit C. Cash in hand

B. Surplus D. Accumulated fund

8. Which of the following is an activity ratio?

A. Gross margin C. Acid test ratio

B. Current ratio D. Rate of Stock Turnover

9. The subscription in arrears is treated in the balance sheet of a social club as a

A. Fixed asset C. Current liability

B. Current asset D. Long term liability

Financial accounting mock questions

10. Net turnover is referred to as

A. Purchase C. Sales

B. Assets D. Profit

Financial accounting mock questions

11. The overall profitability of a business is measured by

A. Acid Test Ratio

B. Return on Capital Employed

C. Current ratio

D. Debtors Collection period

12. In a not-for-profit making organization, the receipts and payments account is the equivalent of

A. Profit and loss account

B. Income and expenditure account

C. Cash book

D. Balance sheet.

Financial accounting mock questions

13. One of the characteristics of useful accounting information is

A. Profitability C. Efficiency

B. Comparability D. Liquidity

14. A statement of Affairs shows

A. Receipt and Payment

B. Revenue and expenditure

C. Financial position

D. Profit and loss

15. Which of the following is not an income generating activity for a social club?

A. Subscriptions

B. Bar trading

C. Maintenance of ground

D. Life membership dues

Financial accounting mock questions

16. The accounting concept which states that expenditure involving insignificant amounts should be regarded as expenses and not assets is

A. Business entity concept

B. Materiality concept

C. Dual aspect concept

D. Realization concept

17. The total debtors account in a single entry system is used to determine

A. Credit Purchases C. Cash Purchases

B. Credit sales D. Cash sales

18. A disadvantage of single entry system of book keeping is that

A. The profit for the period is

B. It is difficult to determine profit for the period

C. Total sales for the period is reduced

D. The owner of the firm withdraws money from the enterprise.

Financial accounting mock questions

19. Incomplete records arises when

A. The ledgers are less than required

B. Some transactions are not in cash

C. The double entry principle is not applied

D. All accounts are in one ledger

20. Which of the following is used to determine sales figure in an incomplete account?

A. Control account C. Cash account

B. Bank account D. Profit and Loss A/c

Financial accounting mock questions

21. Control accounts check the

A. Arithmetical accuracy of the ledgers

B. Calculation of the figures

C. Balances in the ledgers

D. Debit and credit entries

Financial accounting mock questions

22. Where there is no partnership agreement, advances by any partner in excess of capital contributed shall attract interest of

A. 5% C. 15%

B. 10% D. 20%

23. Which of the following items does not feature in control account?

A. Bad debt recovered

B. Discount allowed

C. Provision for bad debt

D. Return outwards

24. In sales ledger control account, bad debts written off is recorded as

A. Credit entry C. Balance b/d

B. Debit entry D. Contra entry

Financial accounting mock questions

25. When an item is entered in the wrong class of account, the error committed is an error of

A. Principle C. Compensation

B. Duplication D.

Commission

26. The process of using sales ledger balance to cancel off purchases ledger balance is

A. Cancellation C. Control

B. Provisions D. set – off

27. Control account are found in the

A. Sales journal C. Purchases journal

B. General ledger D. Nominal ledger

Financial accounting mock questions

28. A debit balance on the bank statement indicates that

A. The bank is a debtor to the customer

B. The customer is a debtor to the bank

C. A cheque issued by the customer has not been presented

D. The customer’s account is closed.

29. Which of the following is true when a bank reconciliation statement starts with an overdraft as per cash book?

A. Deduct uncredited cheques

B. Add uncredited cheques

C. Deduct dishonoured cheques

D. Add unpresented cheques

30. A cheque of GHȼ 600,000 received from Jonas was credited to the account of Jonah. This is an error of

A. Original entry C. Principle

B. Commission D. Omission

Financial accounting mock questions

31. In preparing partnership accounts, interest on drawings is debited to current account and credited to

A. Capital account

B. Appropriation account

C. Drawings account

D. Profit and loss account

32. A credit bank balance is shown on a balance sheet as a

A. Gross profit C. Fixed asset

B. Current liability D. Long term liability

33. Which of the following is not credited to an adjusted cash book?

A. Bank charges C. Debit transfer

B. Dishonoured cheque D. Credit transfer

Financial accounting mock questions

34. Accounting errors are corrected through the general journal because

A. It provides a means for explaining double entries

B. It saves the book keeper’s time

C. It is much easier to do

D. It saves space in the ledger

35. What error is committed if a plant is purchased for GHȼ 8,800,000 but its value is recorded in the books as GHȼ 8,080,000?

A. Principle C. Reversal of entry

B. Commission D. Transposition

36. Which of the following is not a current asset?

A. Stock of goods C. Deposit account

B. Sundry debtors D. Sundry Creditors

Financial accounting mock questions

37. Which of the following is not on the Total Debtors Account?

A. Cash received from debtors

B. Discount allowed to debtors

C. Purchases during the period

D. Return inwards during the period.

38. Which of the following items will appear in the Total Creditors Account?

A. Discount allowed C. Cash purchase

B. Credit sales D. Discount received

39. Which of the following is the appropriate basis for apportioning rent and rate in departmental account?

A. Purchases C. Floor space occupied

B. Sales D. Value of assets

Financial accounting mock questions

40. Which of the following is not an account?

A. Cash book C. Imprest cash book

B. Balance sheet D. Income statement

Financial accounting mock questions

41. The personal account of creditors are found in the

A. General ledger C. Nominal ledger

B. Purchase ledger D. Sales ledger

42. Which of the following is not treated in the profit and loss account?

A. Office expenses C. Carriage inwards

B. Salaries and allowance D. Discount allowed

Financial accounting mock questions

43. Which of the following is not an item in the trading account?

A. Return outwards C. Carriage outwards

B. Return inwards D. Carriage inwards

Financial accounting mock questions

44. The accounting concept that provides that accounting statements should not be influenced by personal opinions is

A. Materiality C. Objectivity

B. Periodicity D. Conservatism

Use the following information to answer questions 45 and 46

GHȼ

Sales 60,000

Gross profit 25,000

Net profit 12,000

Opening stock 3,000

Closing stock 5,000

45. The stock turnover rate is

A. 15.5 times C. 8.75 times

B. 1.5 times D. 6.25 times

Financial accounting mock questions

46. The net profit margin is

A. 58.3% C. 41.67%

B. 25% D. 6.20%

47. Which of the following books serves a dual purpose in Accounting?

A. Return inwards book

B. Sales day book

C. Return outwards book

D. Cash book

48. Which of the following is the most liquid?

A. Cash at bank C. Trade debtors

B. Stock D. Prepayments

49. Real accounts refer to accounts of

A. Intangible assets

B. Tangible assets

C. Short – term liabilities

D. Long – term liabilities

Financial accounting mock questions

50. The Cost of Equipment is GHȼ120,000. If the residual value of the Equipment isGHȼ20,000 and the estimated useful life is 4 years. Calculate the depreciation charge for the asset using the straight line method.

A. GHȼ35,000 C. GHȼ25,000

B. GHȼ30,000 D. GHȼ20,000

PAPER 2 THEORY

(Answer two questions only from this section)

1). a). Describe the following in relation to manufacturing accounts.

i). Prime cost ii). Factory cost

iii). Manufacturing profit iv). Overheads

b). Describe the three types of stocks in a manufacturing concern

2). a). Explain the following terms:

i). Accumulated Fund ii). Statement of Affairs

b). List three sources of income for a not – for – profit– making organization.

c). State three differences between Receipts and Payment Account and Income and Expenditure Account.

Financial accounting mock questions

3). a). What is VAT?

b). Distinguish between Input VAT and Output VAT

c). State three characteristics of VAT.

d). Explain the following:

i). The imprest system ii). Debit Note

4). a). Distinguish between Bank Statement and Bank Reconciliation Statement

b). State two differences between bank overdraft and bank loan

c). Explain the following terms:

i). Credit transfer ii). Standing order

iii). Bank Overdraft

PRACTICE (answer three questions from this section)

5). On 30 th April 2020, Old Soldier’s cash book showed a debit balance of GHȼ7,200,000. On the same date his bank statement balance showed a credit balance of GHȼ4,022,000.

On examination of the records, the following were revealed:

On 1 st April, 2020, the cash book balance was overstated by GHȼ400,000.

A cheque issued for GHȼ275,000 was recorded as GHȼ257,000 in the Cash book.

A cheque of GHȼ9,700,000 received from customers and paid into the bank Account did not reflect in the bank statement

Cheques of GHȼ6,080,000 paid to Creditors had not been presented to the bank for payment.

An amount of GHȼ1,920,000 owed by customers settled their indebtedness by credit transfer.

Standing order given by Old Soldier to his bank was GHȼ1,000,000

Bank charges of GHȼ60,000 appeared on the bank statement only.

You are required to prepare:

a). Adjusted Cash book

b). A bank reconciliation statement as at 30th April, 2020.

Financial accounting mock questions

6). The information below relates to Paula, a trader, for the month of November, 2021:

November 1: Bought from Isaac Stores: bolts GHȼ 400, Nuts GHȼ 800. All subject to 20% trade discount.

November 8: Sold to Alice: nails GHȼ 280, spanner GHȼ 440 and bolts GHȼ 380.

November 10: Sold to Abigail: bolts GHȼ 360, nails GHȼ 400, Nuts GHȼ 600. All less 15% trade discount.

November 15: Bought from Evans: Nuts GHȼ880, nails GHȼ 520. All subject to 25% trade discount.

November 20: Return: bolts GHȼ50, Nuts GHȼ 80 to Isaac stores.

November 22: Goods returned by Alice: nails GHȼ 45 and Spanner GHȼ 60

November 25: Sold to Victoria: nails GHȼ 420 subject to 10% trade discount, Nuts GHȼ 480.

November 25: Bought from Aisha: nails GHȼ 900 and Nuts GHȼ 500

November 28: Returned to Evans: Nuts GHȼ 100

November 30: Victoria returned goods: nails GHȼ 40 and Nuts GHȼ 120

Required: a). Prepare the relevant books of prime entry

b). Post to the relevant ledgers

Financial accounting mock questions

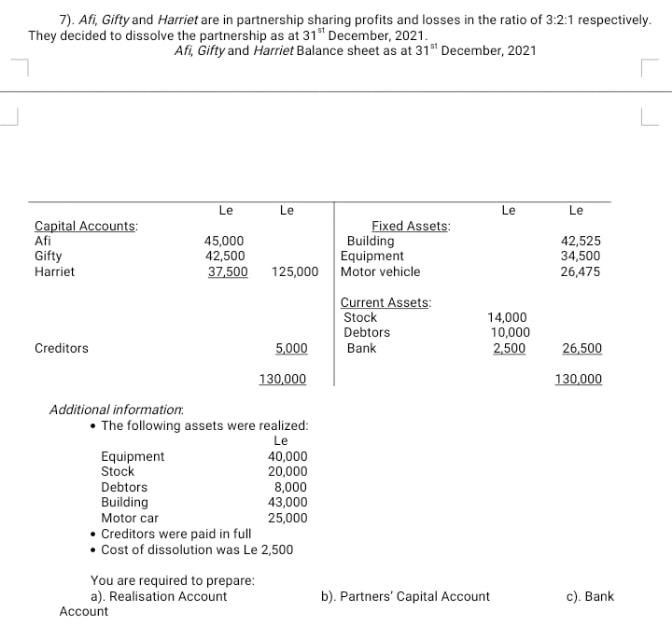

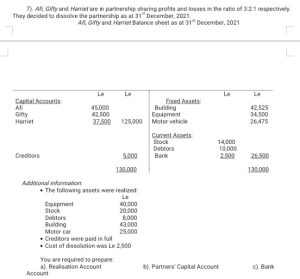

7). Afi, Gifty and Harriet are in partnership sharing profits and losses in the ratio of 3:2:1 respectively. They

decided to dissolve the partnership as at 31 st December, 2021.

Afi, Gifty and Harriet Balance sheet as at 31 st December, 2021

Financial accounting mock questions

8). The totals of a trial balance prepared by Frankees Enterprise did not agree. The difference of GHȼ3,090 was placed in a Suspense account. The following errors were detected:

i). The Salary Account was overcast by GHȼ2,350

ii). Rent received of GHȼ1,900 was debited to the Rent Received Account.

iii). Purchase Account was under cast by GHȼ160.

iv). The Discount Received Account was under cast by GHȼ3,000

v). Commission Received Account was debited with GHȼ1,000 and Bank Account credited with the same amount.

vi). Return inwards was overcast by GHȼ1,280.

vii). Goods sold on credit to Jacob for GHȼ5,000 was posted to the Sales Account only.

viii). Sales of Fitting for GHȼ4,950 to Joshua on credit was posted to his account as GHȼ4,050 but correctly recorded in the Fittings Account.

You are required to:

a). Prepare Journal entries to correct the errors.

b). Write up the Suspense Account.

Financial accounting mock questions

9). The following balances were extracted from the ledgers of Mugabi Enterprise ended 31 st December, 2022:

GHȼ

Debit balance – Sales ledger 30,000

Credit balance – Purchase ledger 45,000

Discount received 15,000

Bills payable 8,300

Discount allowed 10,000

Credit sales 500,000

Credit purchase 240,000

Returns outwards 19,000

Return inwards 12,000

Cash payments to suppliers 180,000

Cash received from debtors 300,000

Dishonoured cheque from customers 40,000

Bad debt written off 12,000

Bills receivable 13,000

31/12/2022

Debit balance – Sales ledger 143,000

Credit balance – Purchase ledger 62,700

You are required to prepare:

a). Sales Ledger Control Accounts

b). Purchases Ledger Control Accounts

Post Disclaimer

The information contained in this post is for general information purposes only. The information is provided by Educative News and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.